COVID cases are increasing, outpacing April’s daily number of new reported infections.

According to White House health adviser Dr. Anthony Fauci, it’s possible that the new daily number of reported infections could surpass 100,000 per day.

This surge in cases will impact B2B companies in different ways. While industries like air travel and events will continue to bear the brunt, other industries will have increased opportunity to highlight their value.

Which B2B industries are investing more in their advertisements and positioning themselves in new ways?

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

Medical and Pharmaceutical

Health is top of mind right now. In the past, pharmaceutical companies were criticized for greed, corruption and high prices. While these criticisms may still be founded, pharmaceutical companies are the public’s hope for a treatment and a vaccine.

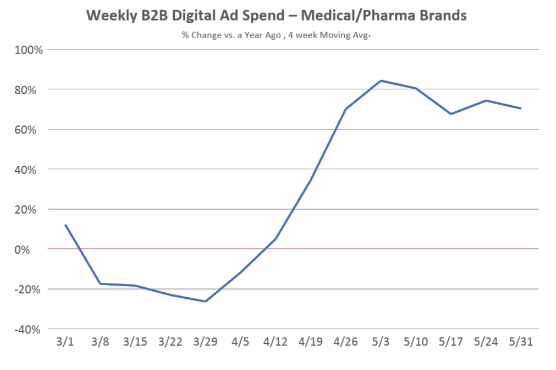

As states began to reopen and elective procedures began happening again, medical and big pharma brands drastically increased their advertising spend.

In early March spend was up roughly 15% YoY. With the initial shock of COVID, the YoY spend dropped, but by the beginning of April, it was up 71% YoY.

Twenty-three different companies are currently working on a coronavirus treatment and/or vaccine, but these companies are not the largest spenders in advertising.

The largest driver here is prescription drugs. In particular, cancer drugs are seeing an increase in ad spending.

Cancer doctors have been put in a difficult spot during the pandemic, and it’s possible more are turning to prescription drugs instead of in-person treatments.

Websites that benefited most from the large spikes included:

- BioPharm International

- Primary Care Optometry News

- ContractPharma.com

- Pharmaceutical Technology

Certain sub-categories saw larger rises:

- BioTech: +171%

- Prescription Drug: +123%

- Imaging Devices: +115%

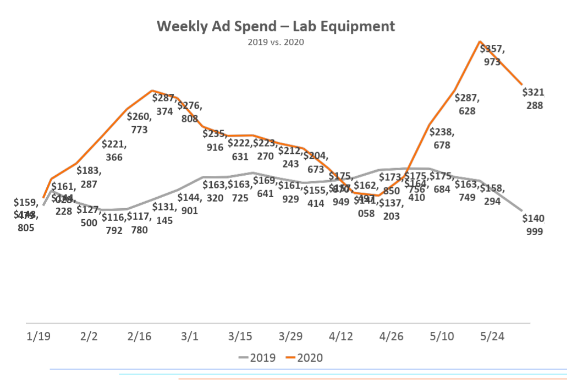

Lab equipment brands have also responded accordingly. Year-to-date ad spend from this group is up by 48%.

Industrial

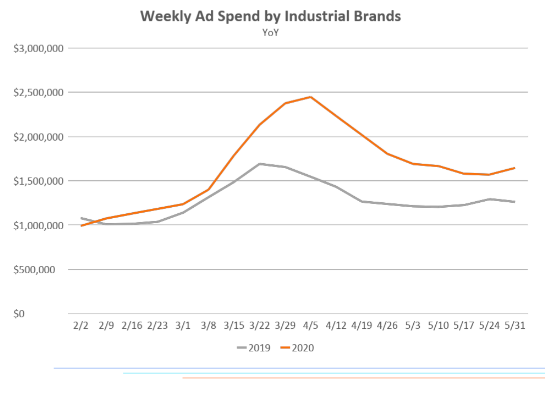

Industrial companies quickly adjusted to the COVID-19 pandemic, shifting quickly into digital advertising.

Industrial brands are the third largest B2B product category in B2B advertising. This category is made up of sub-categories like:

- Industrial Machinery

- Construction Equipment & Products

- Ag/Farming

- Chemicals

- Aerospace/Aviation

- Energy

Since March 15th, digital ad spend among websites like, Equipment World, Aerospace Manufacturing and Design, Industrial Equipment News, and Engineering360, has increased 44% YoY.

Of the websites that receive ad dollars from industrial brands, 65% has seen their average weekly ad revenues increase during the pandemic.

While construction experienced its set-backs and challenges, activity picked up quickly compared to other lines of work. Non-essential construction has resumed in all 50 states. This has led to an increase in spend in related sub-categories.

Segments of the Industrial category that played a large part in this spike include:

- Heavy Machinery: +240%

- Construction: +106%

- Agriculture: +88%

Automotive

There have been several changes in the automotive industry during COVID. On the consumer end, automotive advertisers have increased spending, especially among luxury cars and RVs.

Likewise, commercial vehicle companies are increasing their advertising spend as the nation begins driving again.

Since April began, B2B automotive advertising is up 87% YoY.

Professional Services

Professional services was an industry we previously highlighted as being down amid COVID-19. Spend in April was down by almost 1/3 YoY.

However, spend during the week of 5/31 was up 13% YoY. This is the very first week with positive YoY improvement in over 8 weeks. We will continue to track the data to see if this upward trend continues.

The economy has reopened in different ways, but policies and trends may change with the increasing number of infections. Without a vaccine or treatment, the economy is still marked by uncertainty, which impacts advertising spend. Stay up-to-date with the latest B2B advertising data here.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.